[

]

)

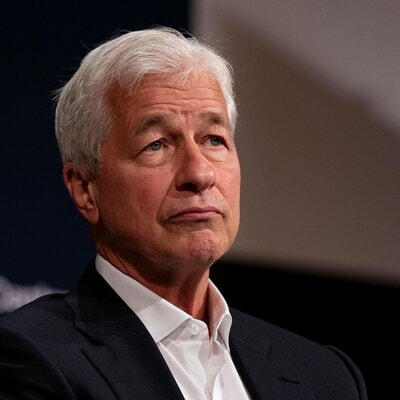

Dimon said last month that he doesn’t “think it matters as much as other people think,” citing ongoing economic uncertainty and inflationary pressures | Photo: Bloomberg

By Hannah Levitt

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said whether the Federal Reserve cuts interest rates by 25 or 50 basis points, the move is “not going to be earth-shattering.”

“They need to do it,” Dimon said at a conference on Tuesday. But “it’s a minor thing when the Fed’s raising rates and lowering rates because underneath that there’s a real economy.”

Fed officials are expected to lower interest rates this week for the first time in more than four years. Ahead of the decision, bond traders have been divided over whether the Fed will cut by a quarter-point or a half point as the central bank continues to pursue a soft landing.

Dimon said last month that he doesn’t “think it matters as much as other people think,” citing ongoing economic uncertainty and inflationary pressures. He’s been warning for more than a year that inflation may be stickier than investors expect, and wrote in his annual letter to shareholders in April that his firm is prepared for interest rates ranging from 2 per cent to 8 per cent or more.

On Tuesday at the Georgetown Psaros Center for Financial Markets and Policy’s annual Financial Markets Quality conference, he said again that geopolitical issues — including wars in Ukraine and the Middle East as well as the US’s relationship with China — are his top concern. It “dwarfs any one I’ve had since I’ve been working,” he said.

“People overly focus on, ‘are we going to have a soft landing, a hard landing?’” Dimon said. “Honestly, most of us have been through all that stuff, it doesn’t matter as much.”

First Published: Sep 18 2024 | 8:59 AM IST