Equity markets are expected to open on a flat-to-positive note amidst positive global cues. Stock markets closed strongly higher on Monday, despite weak GDP data. Analysts expect the positive momentum to continue at least till RBI’s monetary policy outcome on Friday.

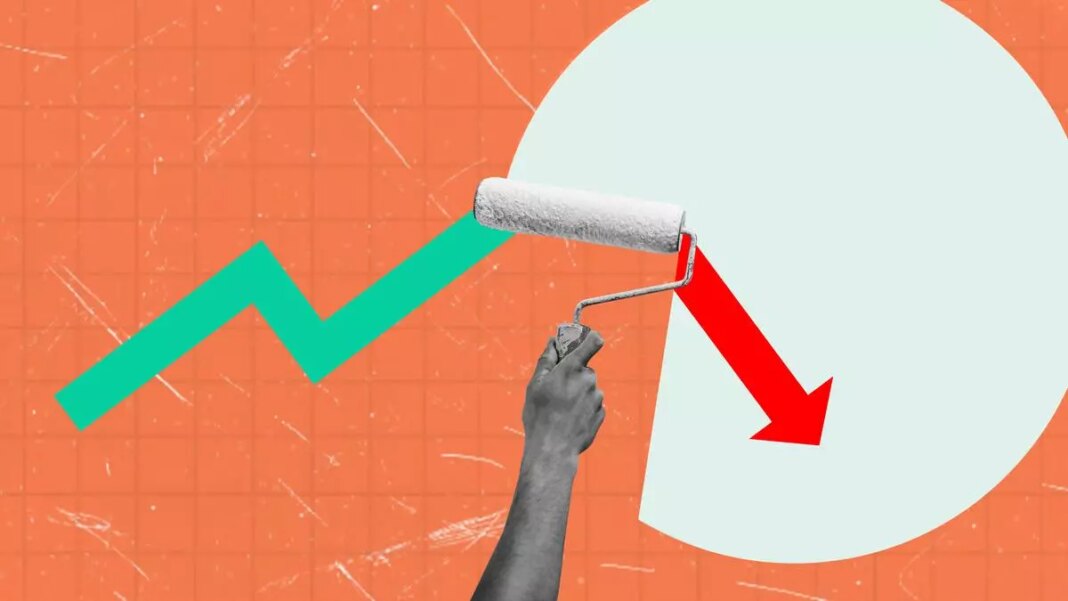

Following the release of the lowest GDP growth number in the last seven quarters, attention is now fixed on RBI’s MPC Policy due this Friday. India’s GDP growth for Q2 FY2024-25 slowed significantly to 5.4 per cent, below expectations, reflecting weakened manufacturing, consumption, and private investment. GVA grew modestly at 5.6 per cent, with manufacturing dipping to 2.2 per cent. However, agriculture provided some relief, rising 3.5 per cent, aided by a favourable monsoon.

According to Harsimran Sahni, Executive Vice-President & Head – Treasury, Anand Rathi Global Finance, “considering the GDP data, which missed its projection for the second consecutive quarter, pressure has built. However, inflation data also saw a sudden increase (both CPI and Core CPI). The increase in inflation may very well be a seasonal pattern, but Governor Das has consistently emphasised the threat that inflation could pose for the economy, if left untamed. Nevertheless, we understand the significance of GDP data, which came well below expectations. Therefore, the probability of a rate cut in the December policy is as equal as a flip of a coin.”

Gift Nifty at 24,435 signals a flat opening

According to Motilal Oswal Financial, Indian stock markets corrected about 8 per cent from the top over September-November 2024, due to a variety of factors, viz. earnings moderation and elevated valuations in mid-caps and small-caps, along with global factors, such as a fragile geopolitical backdrop in West Asia and a strengthening dollar index, following the Trump victory. FIIs sold equities worth ~$13b in October-November 2024.

“The correction has cooled off valuations in the large-caps, even as the mid/ small-caps trade at expensive multiples. Nifty50 is now trading at 19.5x FY26E EPS, while mid-cap/small-cap indices are trading at 30x/24x one-year forward P/E multiples, off from the September 2024 highs, but still rich vs. their own history as well as relative to Nifty50. Our model portfolio reflects our conviction in domestic structural as well as cyclical themes,” the domestic brokerage said, and added that it is overweight on IT, Healthcare, BFSI, Consumer Discretionary, Industrials, and Real Estate. We are UW on Metals, Energy, and Automobiles.

Meanwhile, a majority of Asia-Pacific stocks are up in early deals on Tuesday.