The Indian benchmark indices were knocked down badly last week. Nifty 50, Sensex and Nifty Bank index tumbled over 4 per cent. Escalating tensions in the Middle East have been weighing on the Indian equities.

Last week, we were bullish and had expected the benchmark indices to go up. That view has gone wrong. The sharp fall last week has turned the short-term picture weak. However, there is no threat for the broader uptrend. Although there is room to fall more from here, supports are coming up which can halt the fall and produce a bounce.

Among the sectors, barring the BSE Metals, up 0.1 per cent, others ended in red last week. The BSE Realty index fell the most. It was down by 7.92 per cent. This was followed by the BSE Auto index which was down 5.94 per cent.

FPIs Sell

The Foreign Portfolio Investors (FPIs) sold Indian equities last week. The equity segment saw a net outflow of about $3.19 billion. The month of October has started on a negative note after having seen a whopping inflow of about $6.89 billion in September. If the FPI sell-off intensifies, then that can continue to keep the Sensex and Nifty under pressure to fall more.

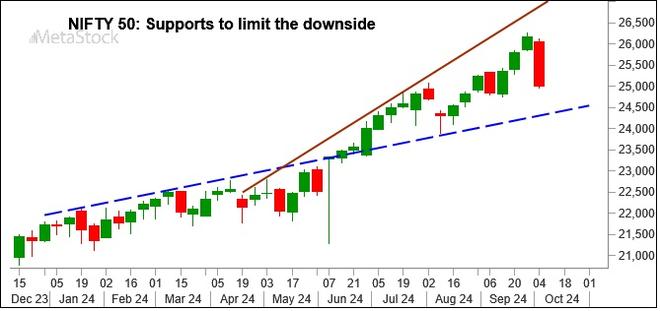

Nifty 50 (25,014.60)

Contrary to our expectation, Nifty tumbled below 25,900 last week. Indeed, the fall has extended well beyond 25,600 last week. The index touched a low of 24,966.80 before closing the week at 25,014.60, down 4.45 per cent for the week.

Short-term view: The daily chart is looking weak. Immediate support is at 24,850-24,800. If Nifty manages to sustain above this support and bounces back, a relief rally to 25,500-25,800 is possible this week. A subsequent rise past 25,800 will then bring back the earlier bullishness into the picture. That in turn will open the doors for the Nifty to revisit 26,000 and higher levels.

But if Nifty declines below 24,800, the current fall can extend to 24,500 or 24,300. The 24,500-24,300 region is a strong support zone. A fall beyond 24,300 might be less likely. As such we can expect the Nifty to begin a new leg of rally from the 24,500-24,300 if the current fall extends beyond 24,850 this week.

Chart Source: MetaStock

Medium-term view: The fall last week has not altered the big picture. At the moment, this looks like a correction within the broad uptrend and not a trend reversal. Strong support is in the 24,500-24,000 region. As long as the Nifty stays above 24,000 the uptrend will remain intact. It will also keep alive the chances of seeing 27,400 and 27,950 on the upside.

As mentioned last week, 27,400 and 27,950 are crucial resistances where the Nifty can find a top. As such we will have to turn more cautious as the index approaches these levels.

The rise to 27,400-27,950 will get negated only if the Nifty declines below 24,000. If that happens, it will signal a trend reversal. That will increase the danger of the fall extending to 23,000 and lower.

Video Credit: Businessline

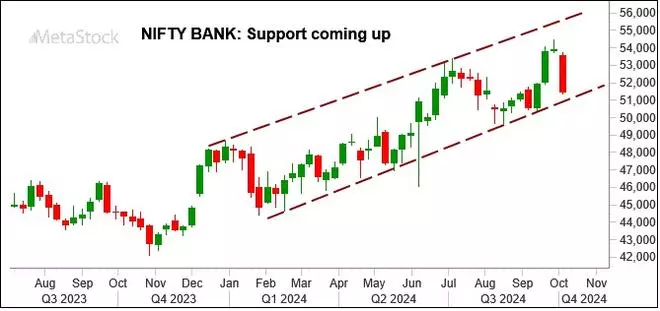

Nifty Bank (51,462.05)

Nifty Bank index tumbled well beyond our expected level of 52,500 last week. The index touched a low of 51,347.25 before closing the week at 51,462.05, down 4.41 per cent.

Short-term view: Immediate support is at 51,200. A break below it can take the index down to 50,000 – the next important support. If the Nifty Bank index manages to bounce back from around 50,000, there are good chances to see a rise back to 53,000. That in turn will ease the downside pressure.

But a break below 50,000 if seen can drag the index down to 49,000. The region around 49,000 is a strong support. A fall beyond 49,000 is less likely.

Chart Source: MetaStock

Medium-term view: On the monthly candles, there is a broad range of 49,650-54,500. On the long-term charts, the level of 49,000 is a very strong support. As such a fall below 49,000 might be difficult as mentioned above. As long as the Nifty Bank index stays above 49,000, the upside is open to target 57,000-58,000.

So, a fall below 50,000 from here will be a very good buying opportunity from a long-term perspective.

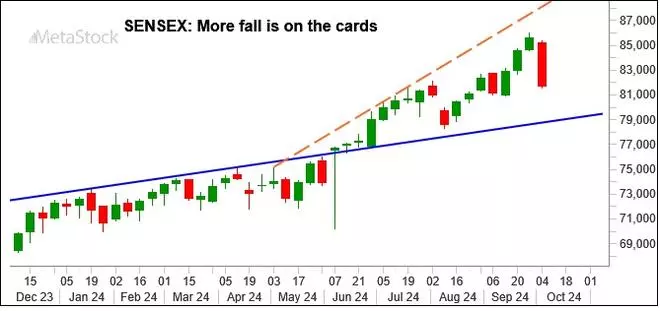

Sensex (81,688.45)

The rise to 88,000 did not happen. On the contrary, Sensex has declined sharply below 84,000. It fell to a low of 81,532.68 and has closed the week at 81,688.45, down 4.54 per cent.

Short-term view: The outlook is negative. Immediate support is at 81,400. A break below it can take the Sensex down to 80,000 and even 79,000 in the short-term. Thereafter we can expect the Sensex to bounce back towards 81,000-82,000 in the short term.

To avoid the fall to 80,000-79,000, Sensex has to sustain above 81,400, and bounce back immediately and breach 83,350.

Chart Source: MetaStock

Medium-term view: The region between 80,000 and 79,000 is a strong support. So, a bounce from this support zone, can take the index back up to 85,000. It will also keep the doors open to target 88,000-89,000 on the upside.

The outlook will turn negative only if the Sensex declines below 79,000. In that case, a fall to 77,500 and lower levels can be seen.

Dow Jones (42,352.75)

The Dow Jones Industrial Average remained subdued for most part of the week. Barring the short-lived fall to the low of 41,847.81 on Thursday, the index sustained above the psychological 42,000 mark last week. The Dow gained some strength on Friday after the jobs data release and recovered all the loss. It has closed the week at 42,352.75, marginally up by 0.1 per cent.

Chart Source: MetaStock

Outlook: The view remains bullish. Strong support is in the 42,000-41,700 region. Immediate resistance is in the 42,500-42,550 region. The bias is positive to breach 42,550 and rise to 43,200-43,300 in the short-term.

We reiterate that from a big picture, the Dow Jones has potential to target 44,300 as long as it stays above 41,000. A correction is possible after this rise.