Indian stock market: The domestic equity benchmark indices, Sensex and Nifty 50, are expected to open lower on Tuesday following a sell-off in global markets.

Asian markets traded lower, while the US stock market ended sharply lower overnight amid selling in technology stocks and as traders tamped down bets for US Federal Reserve interest-rate easing.

Traders heavily scaled back their expectations for another super-sized US Fed rate cut following Friday’s strong US jobs report. They were pricing in an 86% chance of a 25-basis-point cut and a roughly 14% chance the central bank would not cut rates at all, according to the CME’s FedWatch tool.

On Monday, the Indian stock market indices ended sharply lower for the sixth consecutive session amid sustained outflows of foreign funds.

The Sensex plunged 638.45 points, or 0.78%, to close at 81,050.00, while the Nifty 50 settled 218.85 points, or 0.87%, lower at 24,795.75.

“The outflow of ₹30,700 crore by foreign institutional investors in just 3 days of October, along with rising crude oil prices, has negatively impacted overall sentiments. We expect the market to remain under pressure in the near term until FII selling subsides. This week’s focus will be on the RBI policy outcome and the beginning of the Q2 FY25 earnings season,” said Siddhartha Khemka, Head – Research, Wealth Management, Motilal Oswal Financial Services Ltd.

Here are key global market cues for Sensex today:

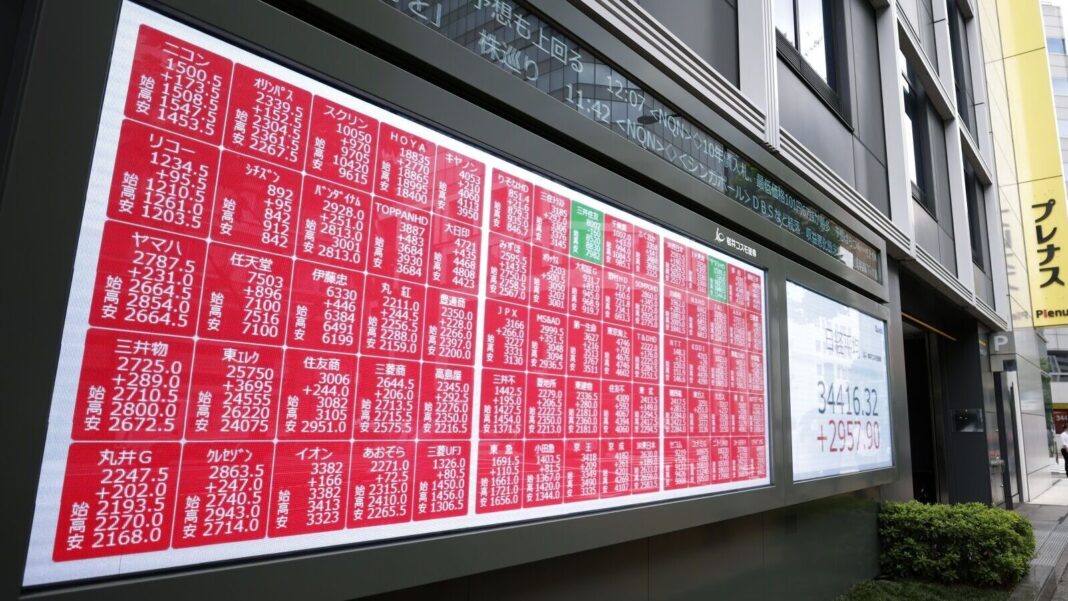

Asian Markets

Asian markets traded mostly lower, tracking overnight losses on Wall Street. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.05%.

Japan’s Nikkei 225 declined 0.75%, while the Topix fell 0.88%. South Korea’s Kospi dropped 0.61%, and the Kosdaq fell 0.14%. Chinese markets jumped over 10% at open after coming back from a long holiday. The CSI 300 index rallied 10.2%, while Hong Kong’s Hang Seng index declined over 3%.

Gift Nifty Today

Gift Nifty was trading around 24,860 level, a discount of nearly 130 points from the Nifty futures’ previous close, indicating a negative start for the Indian stock market indices.

Wall Street

US stock market ended lower on Monday dragged by a sell-off in technology stocks.

The Dow Jones Industrial Average dropped 398.51 points, or 0.94%, to 41,954.24, while the S&P 500 declined 55.13 points, or 0.96%, to 5,695.94. The Nasdaq Composite ended 213.94 points, or 1.18%, lower at 17,923.90.

Alphabet stock price fell 2.5%, Apple stock declined 2.3%, while Amazon share price dropped 3%. Generac Holdings shares rallied 8.52%, Pfizer stock price rose 2% and Air Products and Chemicals stock jumped 9.5%.

Treasury Yields

The benchmark US Treasury 10-year yield topped 4% for the first time in more than two months as markets reduced bets of another super-sized Fed rate cut.

The 10-year yield rose 3.9 basis points (bps) to 4.019%, advancing for a fourth straight session after hitting its highest level since late July of 4.033%, Reuters reported. The two-year US Treasury yield reached its highest since August 19 at 4.0270% and was last up at 3.9764%.

Samsung Q3 Results

Samsung Electronics estimated its third-quarter operating profit jumped 274%, but that was short of analysts’ estimates. The company reported preliminary operating profit of around 9.1 trillion won ($6.8 billion) for the three months ended September 30, versus a 10.3 trillion won LSEG SmartEstimate. That would compare with 2.43 trillion won in the same period a year earlier and 10.44 trillion won in the preceding quarter. Revenue was at 79 trillion won, compared with expectations for 81.57 trillion won.

Japan Real Wages

Japan’s inflation-adjusted wages fell in August after two months of increases during the summer bonus season, while household spending also declined, data showed. Real wages in Japan fell 0.6% in August from the same month a year earlier. That came after a revised 0.3% rise in July.

Separate data showed household spending declined 1.9% from the year-earlier in August, an as against the market estimate for a 2.6% drop based on a Reuters poll, and on a seasonally adjusted basis, spending rose 2.0% from the previous month, marking the fastest pace of increase in a year.

Oil Prices

Crude oil prices fell on profit booking after prices rallied to their highest in over a month.

Brent crude futures declined 0.3% to $80.70 per barrel, while the US West Texas Intermediate futures dropped 0.3% to $76.94 a barrel. Both contracts rose over 3% on Monday to hit their highest levels since late-August.

Gold Rate Today

Gold prices were flat on Tuesday as market participants awaited minutes of the US Fed’s last meeting

Spot gold was little changed at $2,643.68 per ounce, while the US gold futures fell 0.1% to $2,662.90.

(With inputs from Reuters)

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.

Catch all the Business News , Market News , Breaking News Events and Latest News Updates on Live Mint. Download The Mint News App to get Daily Market Updates.

MoreLess