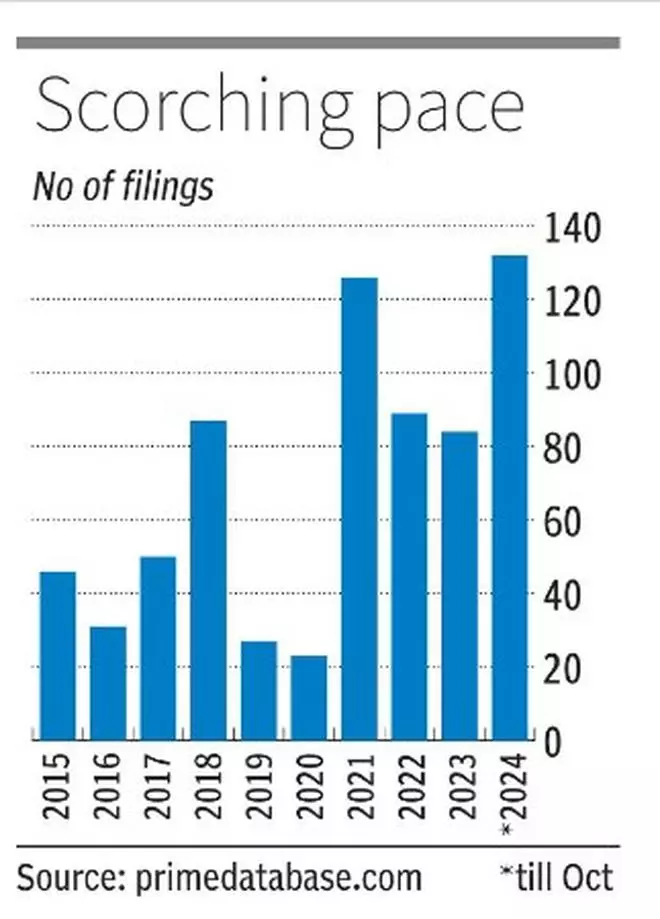

The number of filings for initial public offerings (IPOs) this year has touched a record, surpassing the previous high set three years ago.

Total filings until October stood at 132, higher than the 126 seen in the whole of 2021. The September quarter alone saw 75 filings.

Growth drivers

The hot streak for IPOs has been primarily driven by domestic liquidity and stable macro-economic factors. High subscription numbers and listing pop have promoted companies waiting on the sidelines to move forward with their IPO plans.

“The buoyant secondary market and robust listings until September have encouraged a lot of companies to tap the IPO market,” said Pranav Haldea, Managing Director, PRIME Database.

Sixty-eight IPOs have hit the market this year, mopping up over ₹1.03 lakh crore, data from primedatabase.com show.

Fifty-four out of these companies ended in the green on the day of listing, with 13 companies gaining in excess of 50 per cent. At current prices, 15 companies are sitting with gains of 50-100 per cent over the offer price, while another eight have gained over 100 per cent. Top gainers include Jyoti CNC Automation, up 216 per cent, Platinum Industries (146 per cent) and Bharti Hexacom (143 per cent).

There has been a tangible increase in the speed at which IPOs are getting approved and launched, with companies now coming to the market within a week or two of getting the regulatory nod, said experts.

Slowdown ahead?

The month of October saw only five filings amid the wobble in the secondary market.

“We may see a slowdown in IPO activity going forward if the bearish sentiment continues. No company wants to launch an IPO when the market is volatile,” said Haldea.

Munish Aggarwal, Head of ECM at Equirus Capital, however, believes that the recent market correction may be a temporary blip and there is unlikely to be a substantial let-up in IPO activity unless the volatility continues for 4-5 months.

The pipeline for IPOs remains healthy. Twenty-seven companies have received SEBI approval for their IPOs and another 61 are awaiting regulatory nod. Together, these companies may potentially raise about ₹1.36 lakh crore, according to estimates.