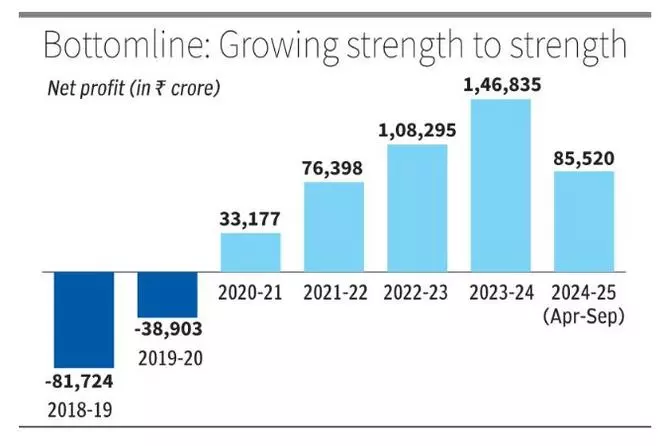

Public sector banks (PSBs), including State Bank of India (SBI), are poised for another stellar year in 2024-25, building on their record-breaking aggregate net profit of ₹1.46 lakh crore in 2023-24, according to the Finance Ministry. This ongoing exceptional performance is the result of a series of “transformative” reform measures implemented in recent years, particularly under the Enhanced Access and Service Excellence (EASE) framework, Finance Ministry noted here on Sunday.

In the first half of FY 2024-25, PSBs (including SBI) reported an aggregate net profit of ₹85,520 crore, a robust 26 per cent growth compared to ₹67,850 crore during the same period last year. This highlights the operational and financial resilience of PSBs, driven by improved asset quality, enhanced credit monitoring, and increased efficiency.

Strengthened Governance and Capital Base

The turnaround in PSBs’ fortunes has been further supported by strengthened governance. The government has ensured arm’s-length selection of top management, introduced non-executive chairpersons for nationalised banks, and filled key leadership positions through market-based recruitment. These measures, coupled with increased capital retention, have bolstered their capital-to-risk-weighted-assets ratio (CRAR), keeping it well above the regulatory requirement.

PSBs have also enhanced shareholder value, distributing ₹61,964 crore in dividends over the past three years. This reflects not only their growing financial strength but also their commitment to rewarding stakeholders, including the government as their principal owner.

Improvement in Asset Quality

The most striking indicator of PSBs’ progress is the sustained improvement in asset quality. Gross non-performing assets (GNPA) have declined significantly to 3.12 per cent in September 2024 from a peak of 14.58 per cent in March 2018. Similarly, Net NPAs (NNPA) have fallen below 1 per cent, underscoring the success of targeted interventions such as rigorous recoveries, improved underwriting standards, and substantial write-offs of legacy bad loans.

A major turning point came in 2015 when the Reserve Bank of India initiated the Asset Quality Review (AQR), mandating transparent recognition of NPAs and reclassification of restructured loans. While this caused a sharp increase in reported NPAs initially, it laid the groundwork for financial discipline and sustainable growth.

Supporting Credit Growth

With improved financial health, PSBs have been pivotal in driving credit expansion across critical sectors such as retail, MSMEs, and infrastructure. Their growing role in green finance and ESG-focused lending further aligns them with India’s sustainability goals.

Pankaj Chaudhary, Minister of State for Finance, recently informed the Rajya Sabha that the government is not contemplating another round of PSB mergers. However, he noted that past consolidations have led to better synergies, economies of scale, and uniform improvement across key financial parameters.

A Key Pillar of Economic Growth

At the current pace, PSBs are expected to exceed last year’s profit milestone of ₹1.46 lakh crore, reinforcing their position as resilient financial institutions and strategic partners in India’s economic growth. With their strengthened fundamentals, PSBs are poised to play a vital role in achieving India’s $5 trillion economy vision while fostering sustainable and inclusive development, said banking industry observers.