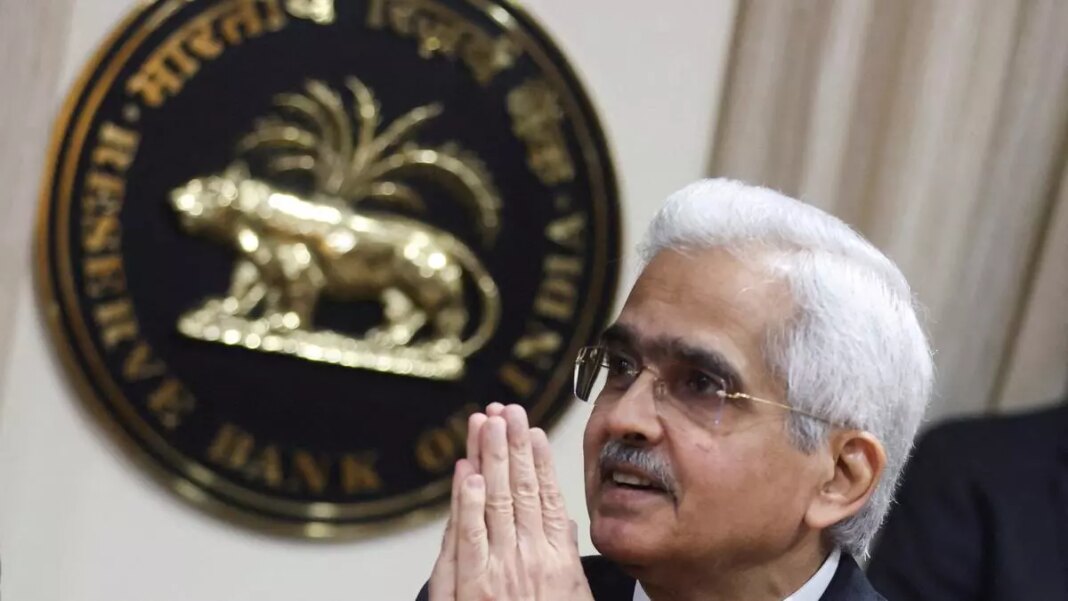

Reserve Bank Governor Shaktikanta Das on Monday said the central bank was constantly working on devising policies, systems, and platforms that will make the financial sector stronger, nimble and customer-centric.

In a keynote address at the Global Conference on Digital Public Infrastructure and Emerging Technologies, a part of RBI@90 initiative here, Das said Digital Public Infrastructure (DPI) and emerging technologies will shape the future journey of almost all economies of the world.

DPI broadly refers to the basic technology systems created mainly in the public sector that are openly available to users and also to other developers.

Das said that over the last decade, the traditional banking system had undergone an unprecedented technological transformation. By all indications, this process is likely to become even more intense in the coming years, he said.

On the country’s experience in DPI, he said, “DPI has enabled India to achieve in less than a decade levels of financial inclusion that would have otherwise taken several decades or even more”.

Referring to last year’s pilot launch of a technology platform which enables frictionless credit, Das said the RBI proposes to name it ‘Unified Lending Interface’ (ULI).

He said the ULI platform facilitates seamless flow of digital information, including land records of various States from multiple data service providers to lenders.

“… based on our experience from the pilot project, a nationwide launch of the ULI will be done in due course,” Governor Das said.

He also emphasised that the UPI system has the potential to evolve into a cheaper and quicker alternative to available channels of cross-border remittances.

The Governor also stressed that financial institutions should be abundantly mindful of risks associated with Artificial Intelligence.

- Also read: Banks regret their deposit slip-up