Royalty payments by listed companies to their related parties, or RPs, have more than doubled in the past decade, a study by market regulator SEBI has shown, hinting at the need for tighter regulations.

Such payments rose 117 per cent to ₹10,779 crore in the 10 fiscal years ending FY23. During the period, there were 1,538 instances of royalty payments within 5 per cent of turnover of the company (not requiring majority of minority shareholder approval) by 233 listed companies.

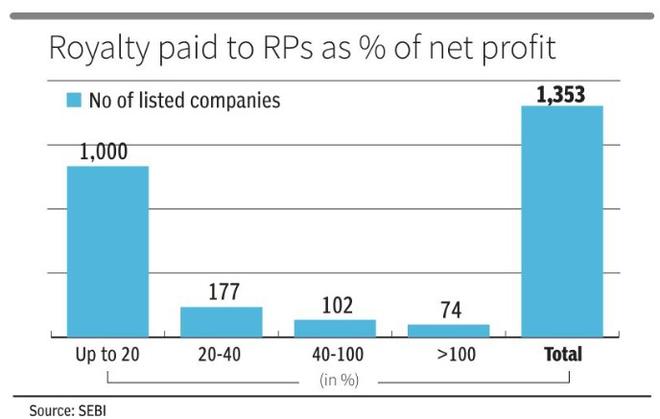

Of these, payments made in 1,353 instances were by listed companies that made net profits. In one out of four such instances, companies paid royalty to RPs exceeding 20 per cent of their net profits. One out of two times, firms that paid royalty, did not pay dividend, or paid more royalty to RPs than dividend paid to non-RP shareholders.

During FY14-23, there were 185 instances of royalty payments by 63 companies that made net losses. Such companies made royalty payment of ₹1,355 crore to their RPs.

Seventy-nine companies consistently paid royalty to their RPs during all the 10 years under study. While aggregate royalty payment by these companies kept pace with growth in turnover and net profits till FY19, royalty payments tempered post FY19. Eleven out of 79 companies consistently paid royalty exceeding 20 per cent of net profits during all the 10 years.

“The data suggest that though the royalty payments made by companies are reasonably within the stipulated threshold (5 per cent of turnover), such payments are unjustifiably high in terms of their profitability,” the SEBI study observed.

The regulator said appropriate disclosures with respect to the rationale and rate of royalty payments are not being provided by companies in their annual reports. Classification of royalty payment made towards the purposes of brand usage and technology know-how is not being disclosed.

Issue faced

In the past, proxy advisory firms have flagged several issues with respect to royalty payments. For instance, such payments have little correlation to the revenue or profits of companies. Companies, at times, seek approval for royalty payments in perpetuity, contrary to the principles of corporate governance. In case of MNCs, shareholders of the Indian subsidiary have little information on the royalty rates being charged in other geographies.

A wider policy discussion may be required on some of the above issues, according to SEBI. For instance, can the royalty payments be linked to the profitability of a company by introducing a suitable threshold in terms of net profits made by the company during the previous year/s?