Transrail Lighting’s IPO was completely subscribed just a few hours after it began accepting bids on Thursday, concluding day 2 on Friday with a subscription of 5,31 times.

The share allocated for retail individual investors (RIIs) received a subscription rate of 6.90 times, while the non-institutional investors’ category was subscribed 7.23 times. The allocation for Qualified Institutional Buyers (QIBs) saw a subscription level of 1.38 times.

The public offering for engineering and construction company Transrail Lighting began on Thursday, December 19, with a price band of ₹410-432 per share. This IPO, which will close on December 23, generated ₹245.97 crore through its anchor book on December 18.

At the highest point of the price range, the IPO has been valued at ₹839 crore, resulting in a market capitalization of approximately ₹5,600 crore.

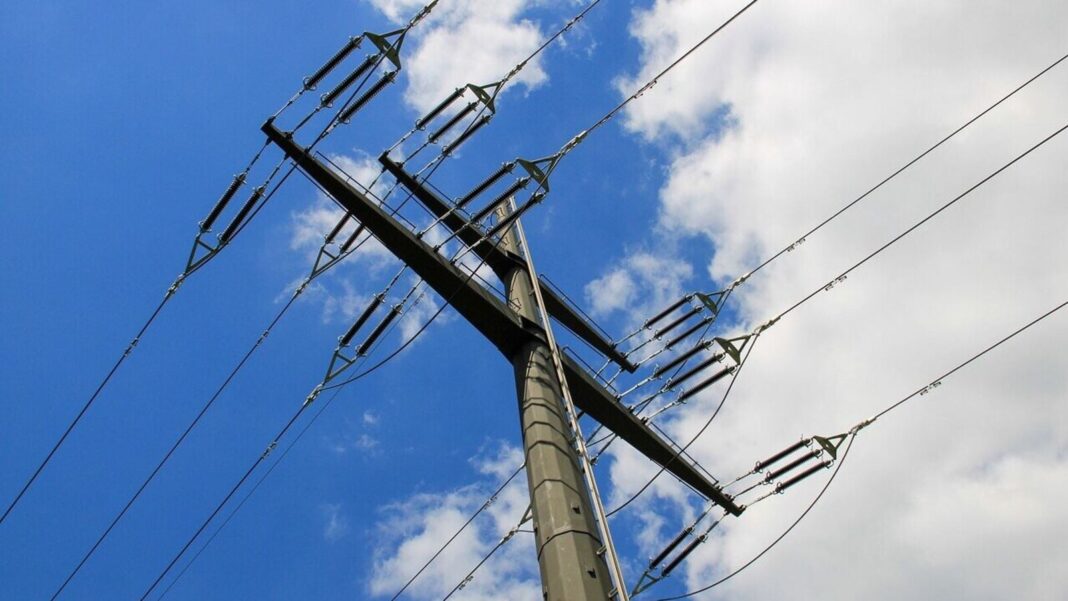

Transrail Lighting stands out as a prominent EPC company in India, primarily concentrating on power transmission and distribution. They also operate integrated manufacturing facilities for lattice structures, conductors, and monopoles.