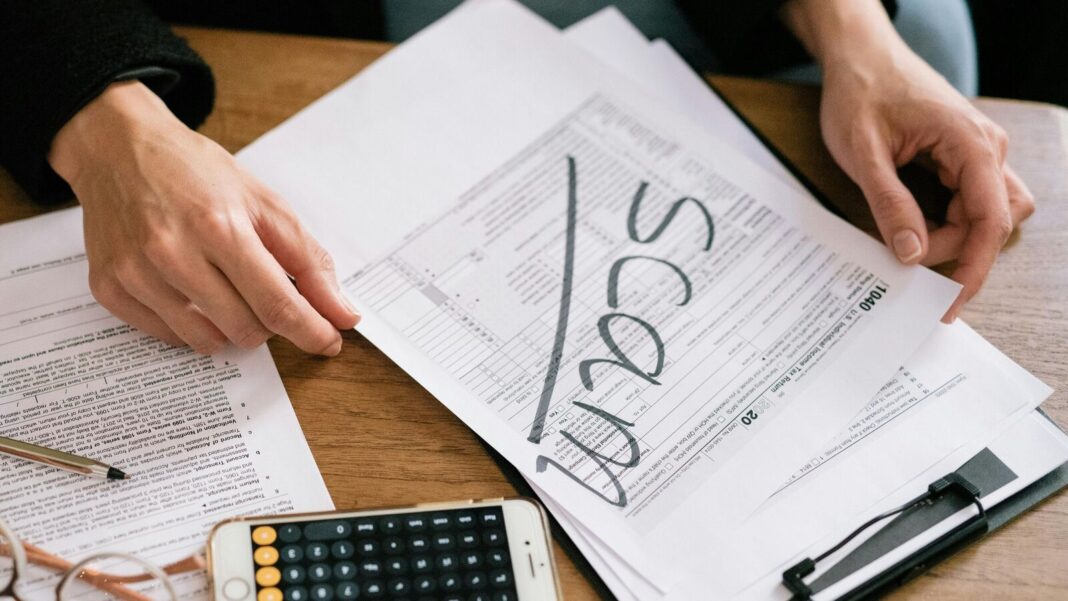

A recent report from the Indian Cyber Crime Coordination Centre reveals that digital financial frauds have cost India an astounding ₹1.25 lakh crore over the past three years.

With the rising prevalence of such scams, Truecaller has introduced its fraud insurance policy in partnership with HDFC Ergo under its “Cyber Sachet” insurance product.

This insurance product, available through the Truecaller app, is crafted to protect users from financial losses resulting from fraudulent activities, providing an added layer of security in an increasingly digital world. Here’s what does it mean:

Who is eligible?

Indian residents aged 18 or older, including foreigners with an Indian phone number regardless of SIM card ownership, and Indian residents travelling abroad temporarily, are eligible.

What’s the coverage amount?

Truecaller offers users up to ₹10,000 in reimbursement for stolen funds due to call or SMS fraud on their Truecaller number. However, this coverage is exclusively available for both Android and iOS users across India.

How to access this coverage?

For existing users, If you currently have an assistant, assistant family, premium, premium family, or gold yearly subscription of Truecaller, this protection comes at no additional cost. You just need to activate the coverage on the app or you will receive this feature automatically upon upgrading to the latest version of the app.

For new users, you need to purchase a premium, premium family, or gold yearly subscription, only then you can access fraud insurance.

However, this insurance is available exclusively to non-business and non-professional users at no additional cost.

How to enable it?

To activate fraud insurance, simply use the Truecaller app and navigate to the premium tab. This registration is a one-time process and will renew automatically with your premium subscription. Additionally, no other documentation is required.

How to file a claim?

If you fall victim to a scam, such as receiving an SMS with a link to a fake website and accidentally providing your account details, or if a scammer tricks you into sharing your bank information over the phone and makes unauthorised transactions, you are eligible to file a claim. This is how you can file a claim:

- Ensure you have an active yearly Truecaller premium subscription.

- Activate your fraud insurance through the premium tab in the app.

- Submit your claim via the premium tab.

- You will be redirected to HDFC Ergo to complete your claim registration.

How many times can you file a claim?

You can file as many claims as needed within a year, provided the total amount of all claims does not exceed ₹10,000. While this coverage may not fully protect against large-scale scams, it ensures you are safeguarded against smaller losses.

Conclusion

In light of the ₹1.25 lakh crore lost to digital fraud in India over the past three years, Truecaller, in partnership with HDFC Ergo, has introduced a Fraud Insurance Policy under its “Cyber Sachet” product. This policy offers up to ₹10,000 in reimbursement for financial losses due to call or SMS fraud.

Available to both Android and iOS users across India, it provides added security for individuals aged 18 and older. Existing premium subscribers can activate it through the app, while new users must purchase a qualifying subscription. This coverage, which renews automatically with your subscription, ensures protection against smaller-scale frauds.

Rohit Gyanchandani is Managing Director at Nandi Nivesh Private Limited

Catch all the Instant Personal Loan, Business Loan, Business News, Money news, Breaking News Events and Latest News Updates on Live Mint. Download The Mint News App to get Daily Market Updates.

MoreLess